georgia ad valorem tax 2021

This calculator can estimate the tax due when you buy a vehicle. To enter your Personal Property Taxes take the following steps.

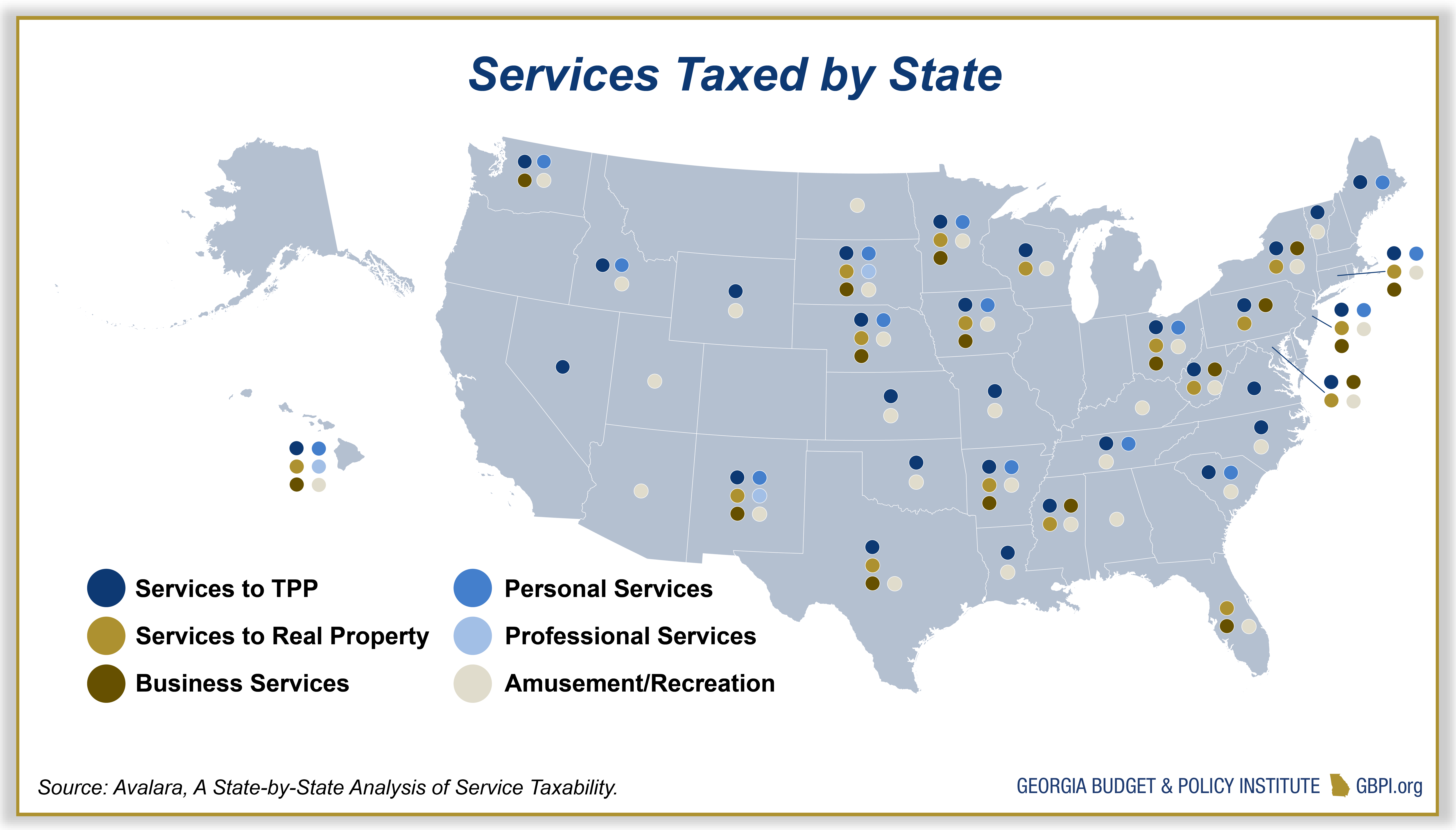

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance.

. Local state and federal government websites often end in gov. The property taxes levied means the taxes charged against taxable property in this state. The TAVT rate will be lowered to 66 of the fair market value of the motor vehicle from 7.

Georgia Tax Center Help Individual Income Taxes Register New Business. 2021 Employers Tax Guidepdf 178 MB Department of Revenue. A reduction is made for the trade-in.

Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. Effective October 1 2021 through December 31 2021 2208 KB General Rate Chart - Effective July 1 2021 through September 30. 1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The tax must be paid at the time of sale by Georgia residents or within six months of. DEKALB STONE MOUNTAIN 21000.

The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. Instead it appears to be a tax in the nature of a sales tax. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or.

Ad Valorem Tax Process For the complete official code of Georgia referred to throughout as OCGA click HERE Property is taxable in the county where it is located unless otherwise provided by law. In a county where the millage rate is 25 mills the property tax on that house would be 1000. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or.

Use Ad Valorem Tax Calculator. Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to provide for a statewide exemption from all ad valorem taxes for timber equipment and timber products held by timber producers to provide for a referendum to. 10 12 22 24 32 35 and 37.

2021 5244 KB Rate Changes Effective July 1 2021 5278 KB. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. DEKALB TAD - 1 KEN04 T104.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. Assessments are by law based upon 40 of the fair market value for your vehicle.

The Georgia Department of Revenue assesses all vehicle values for tax purposes each year. We are excited to implement Senate Bill 65 which ultimately reduces the. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. PTS-R006-OD2020 Georgia County Ad Valorem Tax Digest Millage RatesPage 13 of 43.

Income from retirement sources pensions and disability income is excluded up to the maximum amount allowed to be paid to an individual and his spouse under the federal Social. Your filing status and. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax.

This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. A mill is 110 of 1 cent or 1 per 1000 of assessed value. DEKALB TAD - 1 KEN14 T114.

The cutoff year for reduced TAVT rate 1 for older vehicles changed to 1989 so the reduced rate applies to any person who purchases a 1963 through 1989 model year motor vehicle. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for.

ADMIN 2021-01 - Annual Notice of Interest Rate Adjustment 8564 KB. You will now pay this one-time. Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides.

Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA. Several distinct entities are involved in. Thus the tax would be deductible on Schedule A of Form 1040 if you itemize as part of your state and local sales tax paid however if you choose to deduct sales tax you cannot claim the.

If itemized deductions are also. Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax.

March 17 2021 513 PM. For the 2021 tax year there are seven federal tax brackets. Historical tax rates are available.

TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system. What is ad valorem tax Georgia.

GEORGIA DEPARTMENT OF REVENUE. The Georgia County Ad Valorem Tax Digest Millage Rates have the actual millage rates for each taxing jurisdiction. TAVT Annual Ad.

County District MO Bond. Mar 26 2021 1033 AM. These policy bulletins outline the annual interest rates regarding refunds and past due taxes in the State of Georgia for certain tax years.

When we publish the millage rate we are describing the number of mills. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia.

This tax is based on the value of the vehicle.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Tax Rates Gordon County Government

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

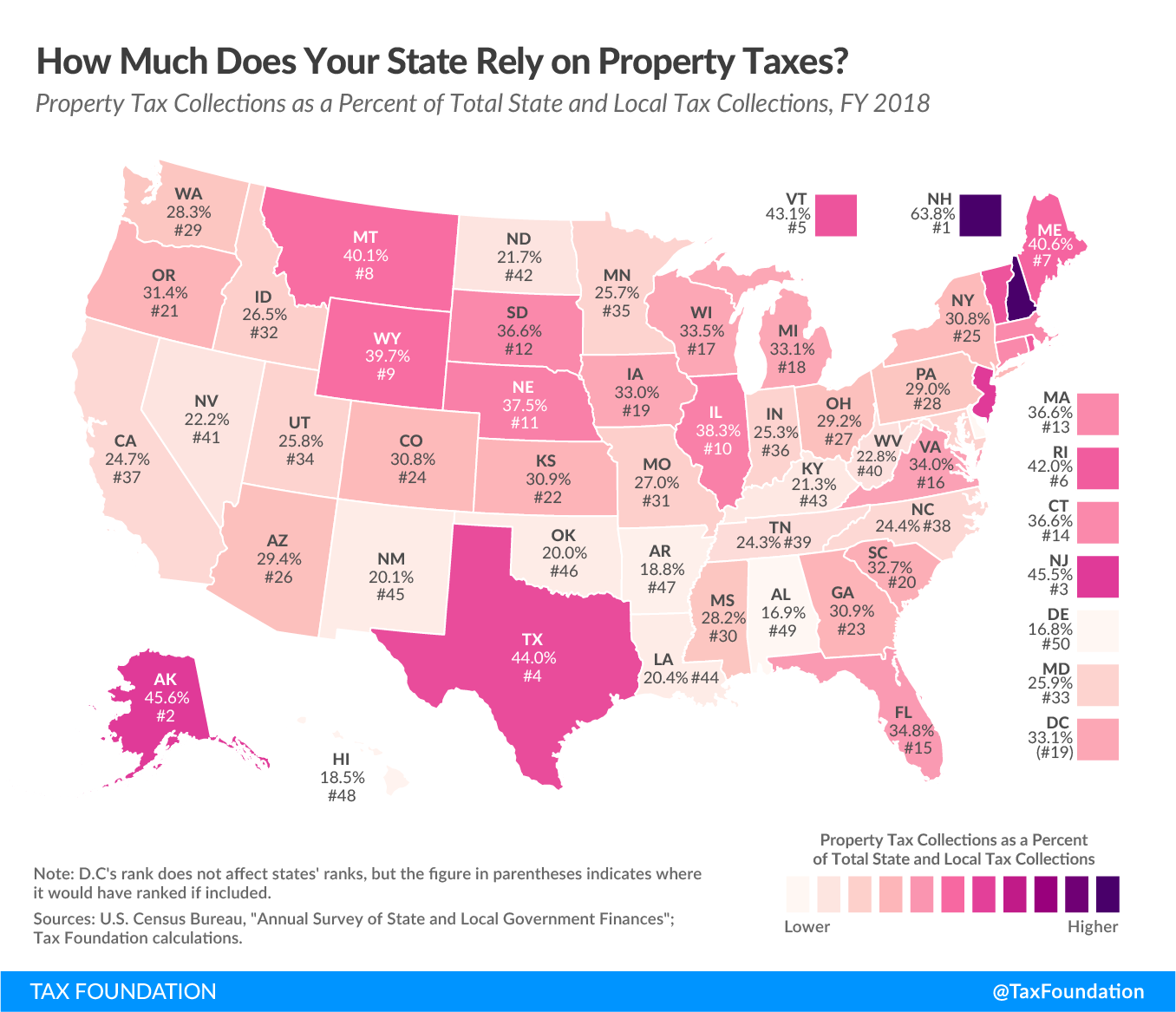

Alaska S Property Taxes Ranked Alaska Policy Forum

Georgia Used Car Sales Tax Fees

Property Taxes Laurens County Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Dekalb County Ga Property Tax Calculator Smartasset

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Finance Tax City Of Jasper Georgia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

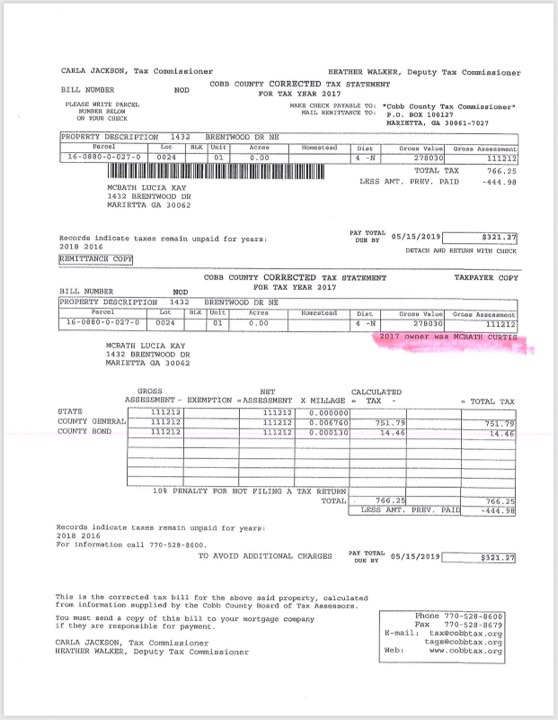

2021 Property Tax Bills Sent Out Cobb County Georgia